What’s Driving Growth in Flexible Packaging?

Used in the food, healthcare and cosmetics markets, flexible packaging is a major part of a global packaging market valued somewhere between $120bn to $160bn depending on the research source. Size estimates vary, but all agree that steady growth is expected. In 2018 the Flexible Packaging Association reported that flexible packaging was the second largest packaging segment in the U.S. garnering about 19% share of all packaging with sales of $31 bn. In 2020, market share remained consistent, but sales grew by about 12% reaching $34.8 bn for the year.

Growth continues despite environmental concerns and regulation. Flex pack containers are made using a variety of substrates consisting of paper, plastic, aluminum foil, coated paper, film, or a combination of these materials. Environmental sustainability concerns are often raised due to plastic use in flexible packaging. The EU introduced initiatives to reduce the use of plastics and other countries and organizations are becoming wary as well. Compound materials can reduce the amount of plastic, but still might need some as barrier material. This environmental pressure will give rise to new substrates that avoid plastic altogether or minimize the use. However, environmental concerns should be viewed in the context that flexible packaging uses notably less plastic than a rigid plastic container alternative.

The trend toward shorter runs and more just-in-time or on-demand production is also driving growth. The desire to order on short notice and often to deliver direct to the consumer during the Corona virus pandemic has dramatically shifted packaging volumes and workflow. Manufacturers find their markets less predictable and need to react quicker. With shifting consumer buying habits, commercial buyers want to keep less stock. Accelerated improvements in the package design and ordering workflow have facilitated a more agile market. Web2Print shops make ordering packaging more efficient for short runs and enable even small companies to have their own packaging professionally printed.

What drives the choice of print process used in flexible packaging?

Most flexible packaging is produced on flexographic presses with a smaller share using gravure or a combination of processes. Neither of these processes are well suited to smaller volume production. Electrophotographic print has made the biggest inroads into flex pack so far. EP toner offers the quality, sufficient width and coverage ranges required for many types of flexible packages. With 31 m/min in 4 color mode the speed is noticeably slower than flexo presses and the speed drops further when using more colors.

Another barrier to entry when it comes to printing flexible packaging is food safety. UV ink can be a challenge due to the monomers included. This could be mitigated by barrier layers or varnishes, but brand owners often prefer to play it safe. Having aqueous inks that print and adhere well to the substrates is a challenge and requires more efforts in priming, inks, drying and handling but provides a more sustainable and safe food packaging product.

Inkjet is not new to flexible packaging, but until recently it has been limited to coding and marking. Adding variable information is an especially important consideration for those in the food industry, as they must display tracking codes, manufacturing and use-by dates as well as the potential for disclosure language that varies by location.

Full graphics inkjet printing has barely made inroads into flexible packaging. Although flexible packaging is a huge market, the challenges are also big. UV inks are undesirable for food packaging and printing with water (aqueous ink) on plastics is challenging. Additionally, the print technology needs to connect well to the subsequent finishing steps in laminating and pouch making. Finally, a large gamut is desirable and offering white can be especially critical.

Still, inkjet can bring high value and vendors are stepping up. Inkjet solutions broadly fall into two tiers: low to mid-range solutions and high-volume solutions. This article focuses primarily on the first tier.

Low to Mid-volume Inkjet Solutions

Low to mid-volume solutions target more occasional uses, smaller packs and enable new, entrepreneurial types of users: such as companies with their own print and pack concept as a service or those offering web-to-pack sales of very short runs or offering sample and mock-up services. Devices in this category do not need to run 24/7 to fulfill their business purpose because the value added outweighs the potential unused press capacity. Footprint and prices are moderate for these devices allowing entry to the market without heavy investments in equipment.

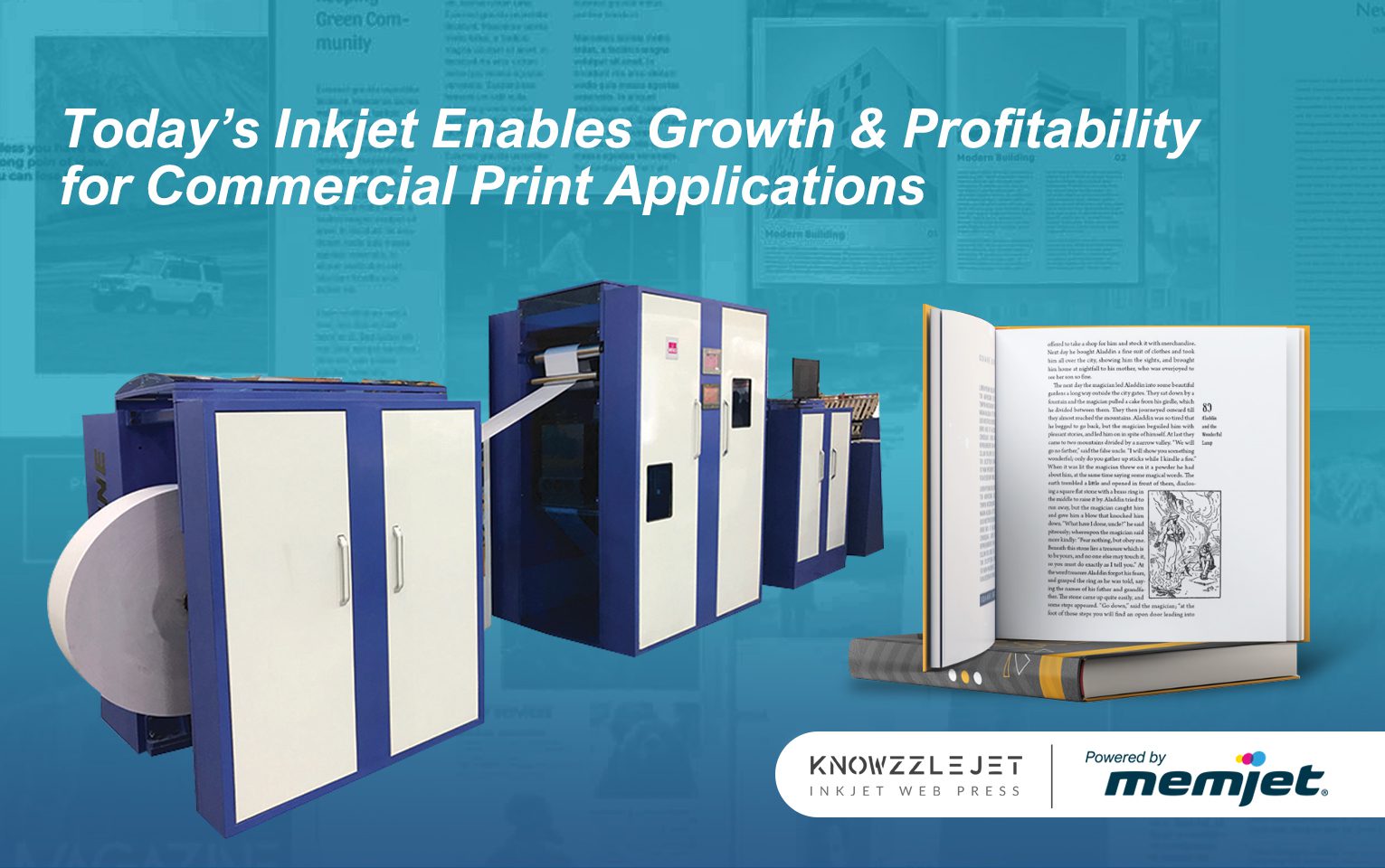

These presses all use Memjet technology and have a relatively small footprint with price points under half a million. It is interesting to see how the Memjet printheads and water-based inks spawned such a variety of solutions in this category.

In 2020 Afinia Label launched the Afinia FP-230, a desktop press for flexible packaging with a maximum media width of 230mm, using Memjet’s VersaPass® DN ink technology. Resolution is 1600 dpi, with speeds up to 18m per minute (with reduced resolution in web direction at top speed). The aqueous inks are recommended for food packaging when combined with inline cold lamination.

AstroNova’s T2-L is an industrial-grade, digital press for flexible packaging utilizing water-based inks along with inline cold lamination. The T2-L narrow web format accommodates a wide range of flexible packaging solutions using Natura™ highly durable, food packaging-safe ink.

The ArrowJet Aqua 330R is a high-speed, aqueous pigment inkjet roll-to-roll press integrated with Colordyne’s ChromaPlex LT print engine. Designed for mid-volume label and packaging production and Powered by Memjet’s DuraFlex technology, the ArrowJet Aqua 330R provides enhanced print quality, fast speeds and greater production flexibility than previous aqueous inkjet technologies.

For the flexible packaging market, the ArrowJet 330R has an optional inline flexo station that can be used to varnish media immediately after printing. This helps create a barrier between the ink and the inside of the packaging to ensure that there is no contamination. It also adds a protective layer to the print to ensure the quality is not compromised before it is converted into the final product. Pricing from Arrow Systems starts at $99,995, fully loaded with inline varnish at $185,000.

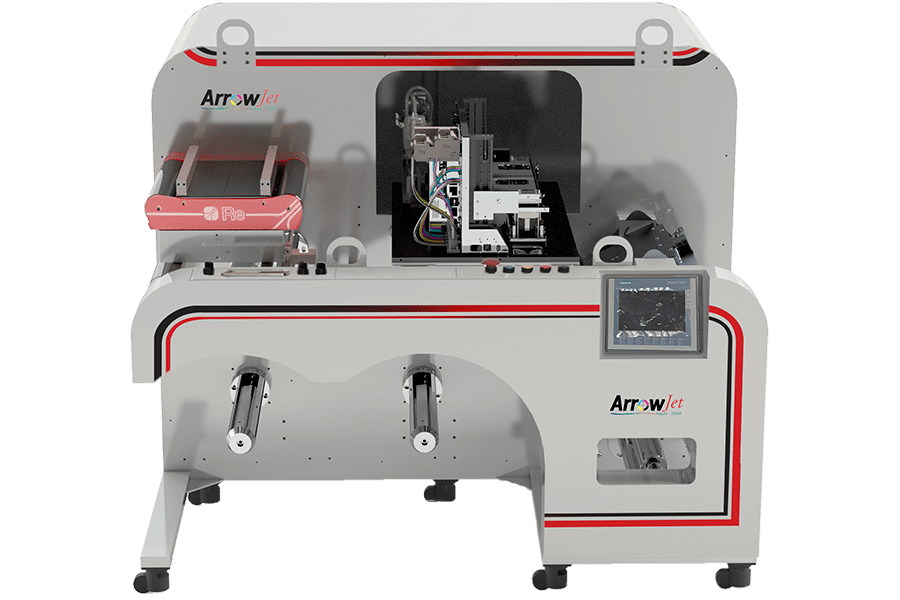

A more specialized solution is the AlphaFlex from V-Shapes, based in Bologna, Italy. The solution provides in-line printing with its six-lane ALPHA packaging machine to enable packaging converters/fillers to accomplish the complete manufacturing process of V-Shapes’ unique single-dose sachets and provide full color branding on both sides of the sachet – in-line, on-demand and with the industry’s highest quality. Sachet sizes range from 40 x 50 mm up to 100 x 100 mm and the filling range is 0.2 to 30 ml. The company supplies pre-coated material optimised for Memjet printheads and two types of laminates are also needed.

A more specialized solution is the AlphaFlex from V-Shapes, based in Bologna, Italy. The solution provides in-line printing with its six-lane ALPHA packaging machine to enable packaging converters/fillers to accomplish the complete manufacturing process of V-Shapes’ unique single-dose sachets and provide full color branding on both sides of the sachet – in-line, on-demand and with the industry’s highest quality. Sachet sizes range from 40 x 50 mm up to 100 x 100 mm and the filling range is 0.2 to 30 ml. The company supplies pre-coated material optimised for Memjet printheads and two types of laminates are also needed.

V-Shapes’ nearline print engine, VS dflex launched earlier this year with a single-portion sachet forming line. The first three units shipped this summer, one to the US, one to Canada and one to Italy, all to existing users of the Alpha filling line. The price level is just above €100k ($120k). Both the AlphaFlex and VS dflex utilize Memjet DuraFlex technology.

Italian manufacturer Rigoli s.r.l. provides a wider web solution for flexible packaging with the MVZ 1000. Rigoli also manufactures a range of wide format printers and ancillary equipment. Accordingly, the MVZ 1000 is based on a 1m / 42” wide format printer, which was adjusted by Rigoli for flexible packaging. The printer uses Memjet technology, giving the press the same max speed of 18 m/min as the Afinia – or 9 m/min at full resolution. As is typical for Powered by Memjet print solutions, the resolution is 1,600 dpi and CMYK print is offered, which includes a double K-channel. The inks are dye-based and safe for food packaging.

The MVZ 1000 is targeted for short and medium runs. Substrates need to have a coating/primer and Rigoli can suggest suitable materials. There is no need for long drying times and materials can be converted quickly. The line is modular and can be a simple roll-to-roll solution or include slitting, laminating or filling. The basic version sells at about €300k ($350k) with a full packing line trading under half a million Euro ($600k US). The MVZ 1000 has been available since 2017 and there are several installations in Europe. Rigoli aims to have more launches for packaging markets in 2021 and 2022.

You can see many of these presses in September at Pack Expo in Las Vegas.

High-volume Inkjet Solutions

High-volume presses are aimed more at today’s flexo press users, although given the limited speed and higher ink costs compared to flexo, for now they will likely be a complement targeting lower runs rather than a straightforward flexo replacement. Since the market is moving to shorter runs, these capabilities are getting more important. So far, the short-run market is underserved as print service providers are not able to offer cost efficient short runs and in turn brand owners adapted their supply chain to long runs.

High volume inkjet presses for flexible packaging allow multi-shift production. They should fit into many production environments where print and converting takes place today. You can find details on high volume inkjet presses for flexible packaging at Inkjet Insight. Recent research from Inkjet Insight found that 72% of customers who reported completing an inkjet integration project said it was a hybrid solution combining inkjet with another production process.

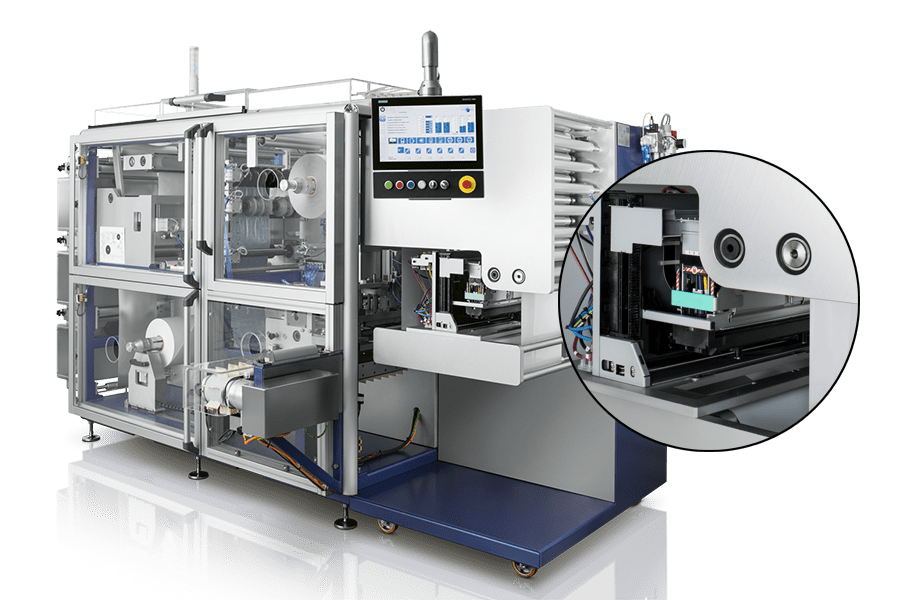

Another option includes PCMC’s Powered by Memjet inkjet printing system called, ION. It is a versatile solution adaptable to meet market demands for new press builds with inkjet and flexography or it can be customized as an inkjet retrofit for a hybrid solution on most any press. The combination of PCMC’s experience in flexographic printing and Memjet’s DuraLink printhead and aqueous pigment ink technology provides a powerful and flexible solution for long and short run printing that can be configured from 8.5” up to 60” print widths.

Inkjet is entering the flexible packaging market from many directions at once and Memjet is helping many OEMs and integrators navigate the path.